Through our research, my team determined that the Grubhub’s decision to acquire Groupon is a sound one, given the fact that the latter has three times the customer base and an international business that would allow the former to expand beyond its current domestic offerings.

Can you construct a deal so that both companies benefit? Groupon’s stock has been on the decline since its IPO in 2011, losing almost 90 percent of its value. The merchandising business requires significant cash investment in order to hold inventory, which has eroded profits in recent years. To stretch growth, it added a discount merchandising business that sells a variety of out-of-season goods at less than half their original MRSP. Groupon has traditionally been an online marketplace, selling discounts and coupons to restaurants, local events, and fitness activities. However, the company has been unable to stave off recent competition and is currently embattled in a fight for market share with Uber’s new food delivery platform, UberEats.

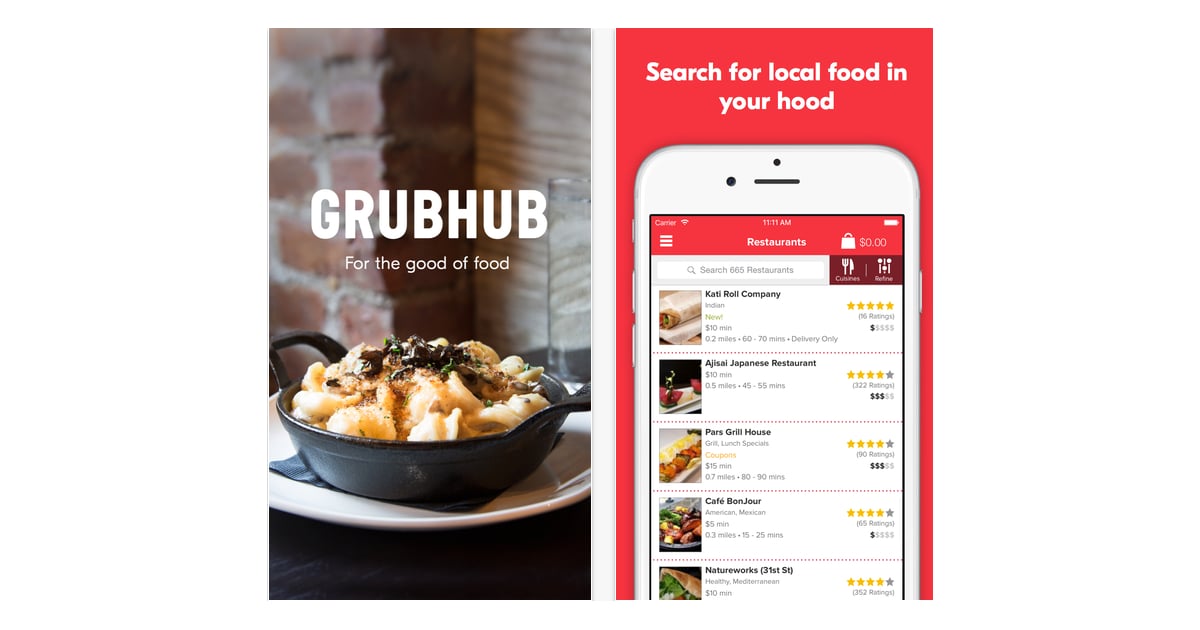

Grubhub is the domestic leader in the on-demand food delivery industry, boasting its Grubhub and Seamless brands, as well as other tuck-in acquisitions that dominate within their local markets. Only one question remained: How do we combine a food delivery company with a discount online retailer and coupon seller? An IBI team dives deep into researching Groupon’s market position within the daily deals industry Grubhub and Groupon: A closer look Much to our surprise, Grubhub and Groupon had some very similar characteristics and could realize significant cost savings in terms of marketing and technology expenses. Our team determined that the first step of the project was conducting company research: downloading both companies’ mobile apps and ordering food from Grubhub This idea was inspired by the story of a Morgan Stanley investment banker who drove Uber for years, an experience that helped him win the rights to advise Uber on its recent IPO.Īfter dumplings and sesame chicken, it was time to dig through the financials and company history. Being our first experience with full mergers and acquisitions (M&A) models, one thing was for certain: this assignment would take us outside of our comfort zone.

The project was part of our Investment Banking Immersion (IBI), directed by Drew Pascarella, Rempe Wilson Distinguished Lecturer and senior lecturer of finance. What are the secrets behind a successful business acquisition? How do you formulate an impressive plan for blending two companies? Those were the questions my classmates and I were tasked with answering for an interesting assignment: evaluate and advise Grubhub on potentially acquiring Groupon. If Grubhub and Groupon merge, one could enjoy breakfasts like this with family and friends

0 kommentar(er)

0 kommentar(er)